This page was generated from

examples/ConsBequestModel/example_WarmGlowBequestPort.ipynb.

Interactive online version: .

Download notebook.

.

Download notebook.

Interactive online version:

Warm-Glow Bequest Motive and Portfolio Choice#

This notebook only provides examples and does not explain the model. It will be revised and expanded in the near future.

[1]:

from copy import copy

from time import time

import matplotlib.pyplot as plt

import pandas as pd

from HARK.Calibration.Income.IncomeTools import (

CGM_income,

parse_income_spec,

parse_time_params,

)

from HARK.Calibration.life_tables.us_ssa.SSATools import parse_ssa_life_table

from HARK.Calibration.SCF.WealthIncomeDist.SCFDistTools import (

income_wealth_dists_from_scf,

)

from HARK.ConsumptionSaving.ConsBequestModel import (

BequestWarmGlowPortfolioType,

init_portfolio_bequest,

)

from HARK.utilities import plot_funcs

[2]:

# First define the portfolio params similar to the notebook solution for that agent type

ConsPortfolioDict = {

# Parameters shared with the Perfect foresight consumer type

"CRRA": 5.0, # Coefficient of relative risk aversion,

"Rfree": [1.03], # Interest factor on assets

"DiscFac": 0.90, # Intertemporal discount factor

"LivPrb": [0.98], # Survival probability

"PermGroFac": [1.01], # Permanent income growth factor

"BoroCnstArt": 0.0, # Artificial borrowing constraint

# Maximum number of grid points to allow in cFunc (should be large)

"MaxKinks": 400,

# Number of agents of this type (only matters for simulation)

"AgentCount": 10000,

# Mean of log initial assets (only matters for simulation)

"kLogInitMean": 0.0,

# Standard deviation of log initial assets (only for simulation)

"kNrmInitStd": 1.0,

# Mean of log initial permanent income (only matters for simulation)

"pLogInitMean": 0.0,

# Standard deviation of log initial permanent income (only matters for simulation)

"pLogInitStd": 0.0,

# Aggregate permanent income growth factor: portion of PermGroFac attributable to aggregate productivity growth (only matters for simulation)

"PermGroFacAgg": 1.0,

"T_age": None, # Age after which simulated agents are automatically killed

"T_cycle": 1, # Number of periods in the cycle for this agent type

"PerfMITShk": False, # Do Perfect Foresight MIT Shock: Forces Newborns to follow solution path of the agent he/she replaced when True

# assets above grid parameters

"aXtraMin": 0.001, # Minimum end-of-period "assets above minimum" value

"aXtraMax": 100, # Maximum end-of-period "assets above minimum" value

# Exponential nesting factor when constructing "assets above minimum" grid

"aXtraNestFac": 1,

"aXtraCount": 200, # Number of points in the grid of "assets above minimum"

"aXtraExtra": [

None,

], # Some other value of "assets above minimum" to add to the grid, not used

# Income process variables

"PermShkStd": [0.1], # Standard deviation of log permanent income shocks

"PermShkCount": 7, # Number of points in discrete approximation to permanent income shocks

"TranShkStd": [0.1], # Standard deviation of log transitory income shocks

"TranShkCount": 7, # Number of points in discrete approximation to transitory income shocks

"UnempPrb": 0.05, # Probability of unemployment while working

"UnempPrbRet": 0.005, # Probability of "unemployment" while retired

"IncUnemp": 0.3, # Unemployment benefits replacement rate

"IncUnempRet": 0.0, # "Unemployment" benefits when retired

"tax_rate": 0.0, # Flat income tax rate

"vFuncBool": False, # Whether to calculate the value function during solution

# Use cubic spline interpolation when True, linear interpolation when False

"CubicBool": False,

# Use permanent income neutral measure (see Harmenberg 2021) during simulations when True.

"neutral_measure": False,

# Whether Newborns have transitory shock. The default is False.

"NewbornTransShk": False,

# Flag for whether to optimize risky share on a discrete grid only

}

[3]:

birth_age = 25

death_age = 90

adjust_infl_to = 1992

income_calib = CGM_income

education = "College"

# Income specification

income_params = parse_income_spec(

age_min=birth_age,

age_max=death_age,

adjust_infl_to=adjust_infl_to,

**income_calib[education],

SabelhausSong=True,

)

# Initial distribution of wealth and permanent income

dist_params = income_wealth_dists_from_scf(

base_year=adjust_infl_to,

age=birth_age,

education=education,

wave=1995,

)

# We need survival probabilities only up to death_age-1, because survival

# probability at death_age is 1.

liv_prb = parse_ssa_life_table(

female=True,

cross_sec=True,

year=2004,

age_min=birth_age,

age_max=death_age,

)

portfolio_params = { # Attributes specific to the Portfolio consumer

"RiskyAvg": 1.08, # Average return of the risky asset

"RiskyStd": 0.20, # Standard deviation of (log) risky returns

"RiskyCount": 5, # Number of integration nodes to use in approximation of risky returns

"ShareCount": 25, # Number of discrete points in the risky share approximation

# Probability that the agent can adjust their risky portfolio share each period

"AdjustPrb": 1.0,

"DiscreteShareBool": False,

}

# Parameters related to the number of periods implied by the calibration

time_params = parse_time_params(age_birth=birth_age, age_death=death_age)

# Update all the new parameters

params = copy(init_portfolio_bequest)

params.update(time_params)

params.update(dist_params)

params.update(income_params)

params.update(portfolio_params)

params.update({"LivPrb": [1.0] * len(liv_prb)})

params["Rfree"] = len(liv_prb) * [params["Rfree"][0]]

[4]:

# Make and solve an idiosyncratic shocks consumer with a finite lifecycle

Agent = BequestWarmGlowPortfolioType(**params)

# Make this consumer live a sequence of periods exactly once

Agent.cycles = 1

print(Agent.BeqFac)

40.0

[5]:

start_time = time()

Agent.solve()

end_time = time()

print(f"Solving a lifecycle consumer took {end_time - start_time} seconds.")

Agent.unpack("cFuncAdj")

Solving a lifecycle consumer took 2.655607223510742 seconds.

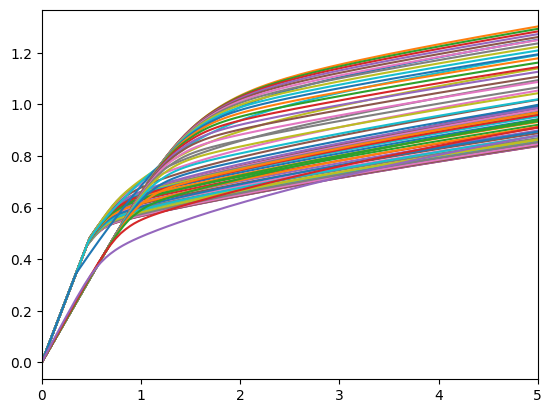

[6]:

# Plot the consumption functions

print("Consumption functions")

plot_funcs(Agent.cFuncAdj, 0, 5)

Consumption functions

[7]:

# Number of LifecycleExamples and periods in the simulation.

Agent.AgentCount = 500

Agent.T_sim = 200

# Set up the variables we want to keep track of.

Agent.track_vars = ["aNrm", "cNrm", "pLvl", "t_age", "mNrm"]

# Run the simulations

Agent.initialize_sim()

Agent.simulate()

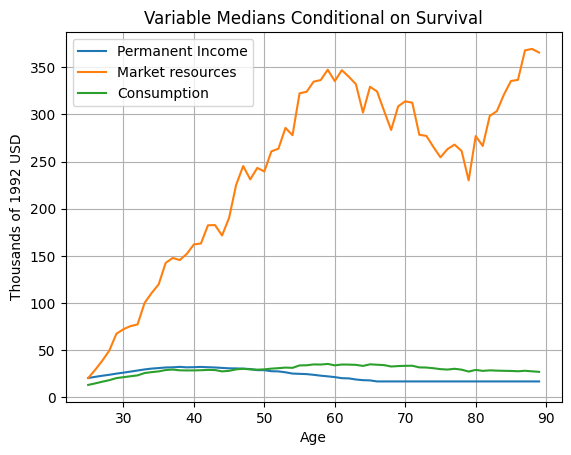

[8]:

raw_data = {

"Age": Agent.history["t_age"].flatten() + birth_age - 1,

"pIncome": Agent.history["pLvl"].flatten(),

"nrmM": Agent.history["mNrm"].flatten(),

"nrmC": Agent.history["cNrm"].flatten(),

}

Data = pd.DataFrame(raw_data)

Data["Cons"] = Data.nrmC * Data.pIncome

Data["M"] = Data.nrmM * Data.pIncome

[9]:

# Find the mean of each variable at every age

AgeMeans = Data.groupby(["Age"]).median().reset_index()

plt.figure()

plt.plot(AgeMeans.Age, AgeMeans.pIncome, label="Permanent Income")

plt.plot(AgeMeans.Age, AgeMeans.M, label="Market resources")

plt.plot(AgeMeans.Age, AgeMeans.Cons, label="Consumption")

plt.legend()

plt.xlabel("Age")

plt.ylabel(f"Thousands of {adjust_infl_to} USD")

plt.title("Variable Medians Conditional on Survival")

plt.grid()

[ ]: