Interactive online version:

Preference Shocks to Consumption Utility#

This module defines consumption-saving models in which agents have CRRA utility over a unitary consumption good, geometric discounting, who face idiosyncratic shocks to income and to their utility or preferences. That is, this module contains models that extend ConsIndShockModel with preference shocks.

ConsPrefShockModel currently solves two types of models:

An extension of

ConsIndShock, but with an iid lognormal multiplicative shock each period.A combination of (1) and 1ConsKinkedR1, demonstrating how to construct a new model by inheriting from multiple classes.

[1]:

from time import process_time

import matplotlib.pyplot as plt

import numpy as np

from HARK.ConsumptionSaving.ConsPrefShockModel import (

KinkyPrefConsumerType,

PrefShockConsumerType,

)

from HARK.utilities import plot_funcs

mystr = lambda number: f"{number:.4f}"

do_simulation = True

Consumption-saving with income risk and preference shocks: PrefShockConsumerType#

PrefShockConsumerType agents are very similar to those in the “idiosyncratic shocks” model, except that in ConsPrefShockModel an agent receives an iid shock to their preference for consumption at the beginning of each period, before making the consumption decision.

The agent’s problem can be written in (normalized) Bellman form as:

\begin{eqnarray*} v_t(m_t,\eta_t) &=& \max_{c_t} U(c_t,\eta_t) + \beta \mathsf{S}_{t} \mathbb{E} [(\Gamma_{t+1}\psi_{t+1})^{1-\rho} v_{t+1}(m_{t+1}, \eta_{t+1}) ], \\ a_t &=& m_t - c_t, \\ a_t &\geq& \underline{a}, \\ m_{t+1} &=& R/(\Gamma_{t+1}\psi_{t+1}) a_t + \theta_{t+1}, \\ (\psi_{t},\theta_{t}) \sim F_{t}, &\qquad& \mathbb{E} [\psi_t] = 1, \\ U(c,\eta) &=& \frac{(c/\eta)^{1-\rho}}{1-\rho}, ~~~ \eta_t \sim G_{t}, ~~~ \mathbb{E} [\eta_t] = 1. \end{eqnarray*}

The one period problem for this model is solved by the function solveConsPrefShock, which creates an instance of the class ConsPrefShockSolver. The class PrefShockConsumerType extends IndShockConsumerType to represents agents in this model.

Note that the utility function was slightly revised after HARK 0.17.0. Previously, \(\eta\) was applied as a multiplicative factor outside the CRRA exponentiation, but it has been moved inside the parentheses now, as a divisor. With default \(\rho = 2\), this actually has no effect at all on the model solution. When using greater values of \(\rho\), the scale of preference shocks needed to attain a given level of variation in \(c_t\) will no longer scale with \(\rho\).

Additional parameter values to solve an instance of PrefShockConsumerType#

To construct an instance of this class, there are 3 additional parameters beyond IndShockConsumerType, as shown in the table below (parameters can be either “primitive” if they are directly specified by the user or “constructed” if they are built by a class method using simple parameters specified by the user).

Param |

Description |

Code |

Value |

Constructed |

|---|---|---|---|---|

\(N{\eta}\) |

Number of discrete points in “body” of preference shock distribution |

|

12 |

\(\surd\) |

\(N{\eta}\) |

Number of discrete points in “tails” of preference shock distribution |

|

4 |

\(\surd\) |

\(\sigma_{\eta}\) |

Log standard deviation of multiplicative utility shocks |

|

[0.30] |

\(\surd\) |

Constructed inputs to solve a PrefShockConsumerType#

The tails of the preference shock distribution are of great importance for the accuracy of the solution and are underrepresented by the default equiprobable discrete approximation (unless a very large number of points are used). To fix this issue, the attribute

PrefShk_tail_Nspecifies the number of points in each “augmented tail” section of the preference shock discrete approximation.The standard deviation of preference shocks might vary by period. Therefore,

PrefShkStdshould be input as a list.

Note that the solve method of PerfShockConsumerType populates the solution with a list of ConsumerSolution instances. These single-period-solution objects have the same attributes as the “idiosyncratic shocks” model, but the attribute cFunc is defined over the space of (\(m_{t}\), \(\eta_{t}\)) rather than just \(m_{t}\).

The value function vFunc and marginal value vPfunc, however, are defined only over \(m_{t}\), as they represent expected (marginal) value just before the preference shock \(\eta_{t}\) is realized.

Example implementation of PrefShockConsumerType#

Like other HARK AgentType subclasses, PrefShockConsumerType includes reasonable default parameters and can be instantiated without passing any additional information. Let’s make an infinite horizon agent with default parameters, but request the solver to build the value function.

[2]:

# Make and solve a preference shock consumer

PrefShockExample = PrefShockConsumerType(

cycles=0, vFuncBool=True

) # default parameters, infinite horizon

[3]:

t_start = process_time()

PrefShockExample.solve()

t_end = process_time()

print("Solving a preference shock consumer took " + str(t_end - t_start) + " seconds.")

Solving a preference shock consumer took 1.140625 seconds.

[4]:

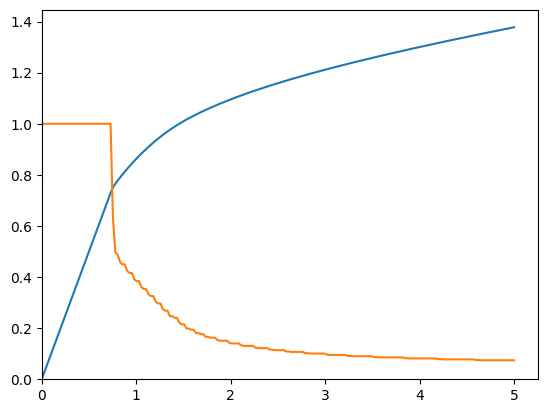

# Plot the consumption function at each discrete shock

m = np.linspace(PrefShockExample.solution[0].mNrmMin, 5, 200)

print("Consumption functions at each discrete shock:")

for j in range(PrefShockExample.PrefShkDstn[0].pmv.size):

PrefShk = PrefShockExample.PrefShkDstn[0].atoms.flatten()[j]

c = PrefShockExample.solution[0].cFunc(m, PrefShk * np.ones_like(m))

plt.plot(m, c)

plt.xlim([0.0, 5.0])

plt.ylim([0.0, None])

plt.xlabel(r"Normalized market resources $m_t$")

plt.ylabel(r"Normalized consumption $c_t$")

plt.show()

Consumption functions at each discrete shock:

[5]:

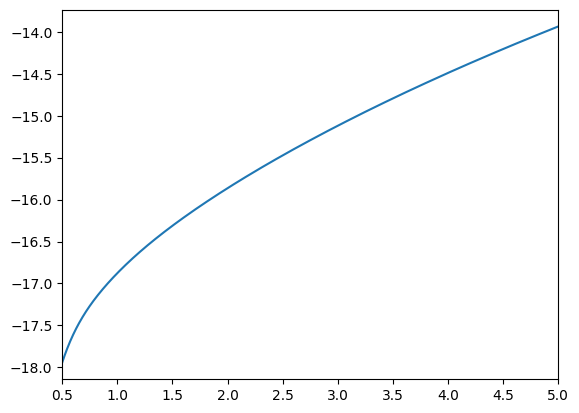

if PrefShockExample.vFuncBool:

print("Value function (unconditional on shock):")

plot_funcs(

PrefShockExample.solution[0].vFunc,

PrefShockExample.solution[0].mNrmMin + 0.5,

5,

)

Value function (unconditional on shock):

[6]:

# Test the simulator for the pref shock class

if do_simulation:

PrefShockExample.T_sim = 120

PrefShockExample.track_vars = ["cNrm"]

PrefShockExample.initialize_sim()

PrefShockExample.simulate()

Utility shocks and different interest rates: KinkyPrefConsumerType#

In this model, an agent faces idiosyncratic shocks to permanent and transitory income and shocks to utility and faces a different interst rate on borrowing vs saving. This agent’s model is identical to that of the ConsPrefShockModel with the addition of the interst rate rule from the KinkedRConsumerType from ConsIndShock model.

The one period problem of this model is solved by the function solveConsKinkyPref, which creates an instance of ConsKinkyPrefSolver. The class KinkyPrefConsumerType represents agents in this model.

Thanks to HARK’s object-oriented approach to solution methods, it is trivial to combine two models to make a new one. In this current case, the solver and consumer classes each inherit from both KinkedR and PrefShock and only need a trivial constructor function to rectify the differences between the two.

Constructed inputs to solve a KinkyPrefConsumerType#

The attributes required to properly construct an instance of

KinkyPrefConsumerTypeare the same asPrefShockConsumerType, except thatRfreeshould not be replace withRboroandRsave- like the “kinked R” parent model.Also, as in

KinkedRandPrefShock,KinkyPrefis not yet compatible with cubic spline interpolation of the consumption function.

Example implementation of KinkyPrefConsumerType#

As above, let’s use default parameters, but make the agent have an infinite horizon and request that the value function be constructed.

[7]:

# Make and solve a "kinky preferece" consumer, whose model combines KinkedR and PrefShock

KinkyPrefExample = KinkyPrefConsumerType(cycles=0, vFuncBool=True)

[8]:

t_start = process_time()

KinkyPrefExample.solve()

t_end = process_time()

print("Solving a kinky preference consumer took " + str(t_end - t_start) + " seconds.")

Solving a kinky preference consumer took 0.921875 seconds.

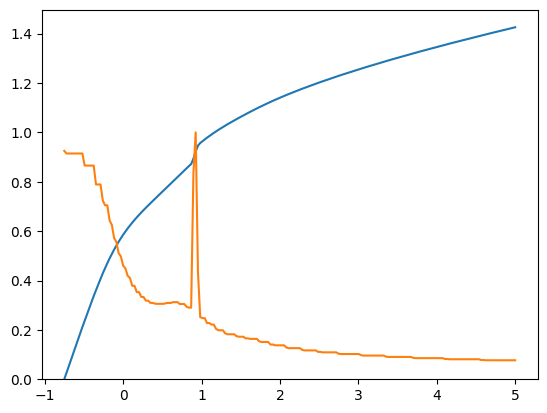

[9]:

# Plot the consumption function at each discrete shock

m = np.linspace(KinkyPrefExample.solution[0].mNrmMin, 5, 200)

print("Consumption functions at each discrete shock:")

for j in range(KinkyPrefExample.PrefShkDstn[0].atoms.size):

PrefShk = KinkyPrefExample.PrefShkDstn[0].atoms.flatten()[j]

c = KinkyPrefExample.solution[0].cFunc(m, PrefShk * np.ones_like(m))

plt.plot(m, c)

plt.ylim([0.0, None])

plt.xlim(-1.0, 5.0)

plt.xlabel(r"Normalized market resources $m_t$")

plt.ylabel(r"Normalized consumption $c_t$")

plt.show()

Consumption functions at each discrete shock:

[10]:

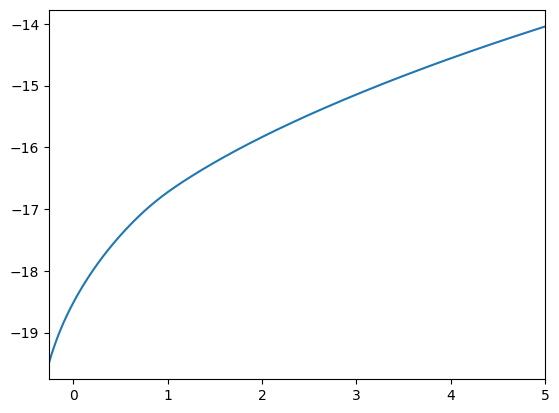

if KinkyPrefExample.vFuncBool:

print("Value function (unconditional on shock):")

plot_funcs(

KinkyPrefExample.solution[0].vFunc,

KinkyPrefExample.solution[0].mNrmMin + 0.5,

5,

)

Value function (unconditional on shock):

[11]:

# Test the simulator for the kinky preference class

if do_simulation:

KinkyPrefExample.T_sim = 120

KinkyPrefExample.track_vars = ["cNrm", "PrefShk"]

KinkyPrefExample.initialize_sim()

KinkyPrefExample.simulate()