Overview#

Introduction to HARK

Learning About HARK

A Gentle Introduction to HARK

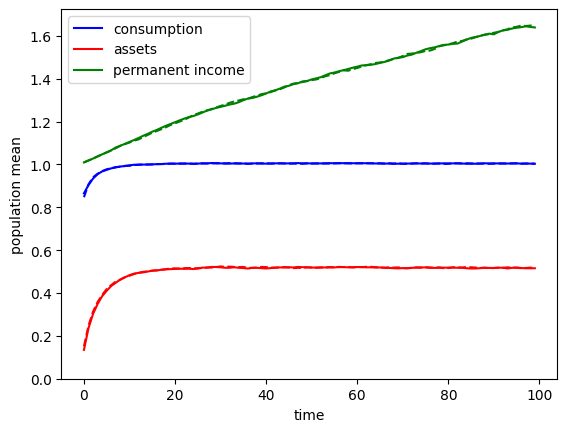

Simulating Microeconomic Models

The Nature of Time for AgentTypes

Constructed Attributes and Model Defaults

Advanced and Uncommon HARK Concepts

Numeric Methods Commonly Used in HARK

Directory of Consumption-Saving Models

Elements of an AgentType Subclass

“Macroeconomic” Models: the Market Class

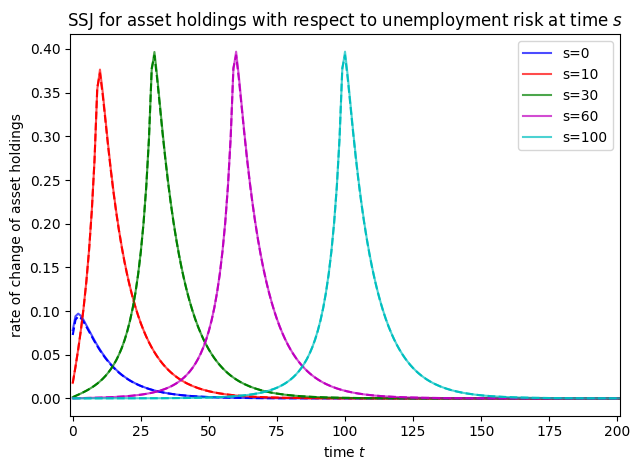

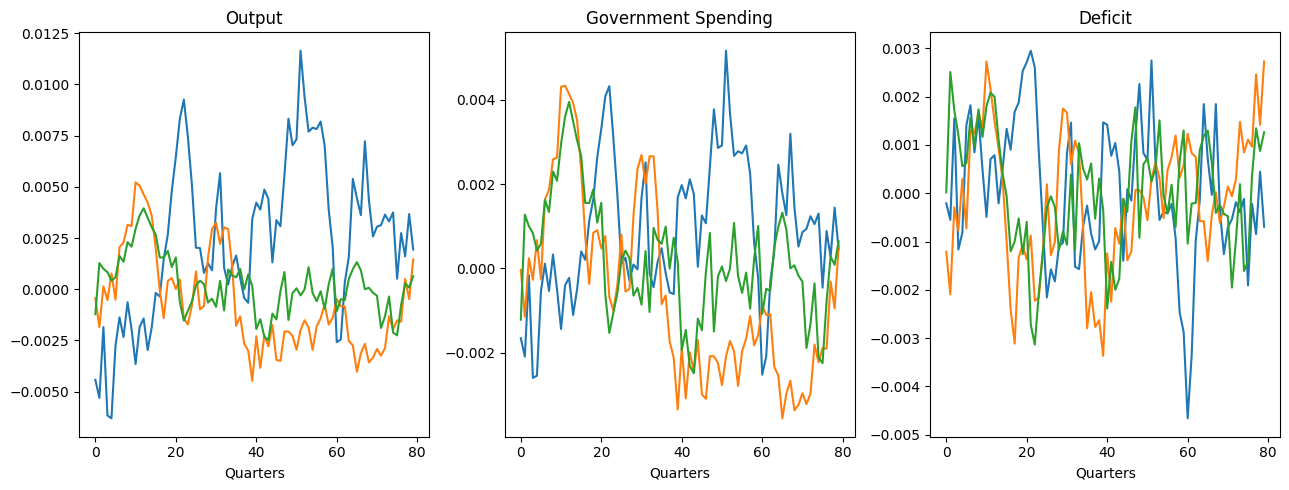

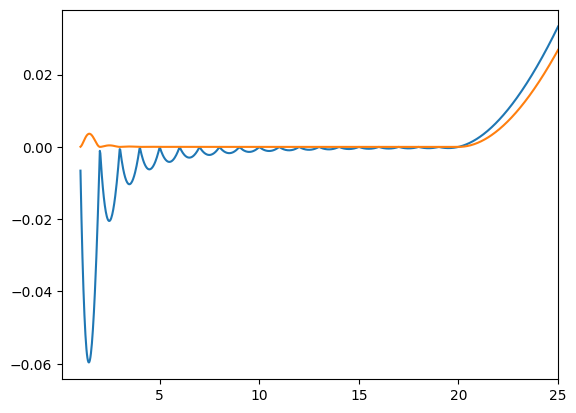

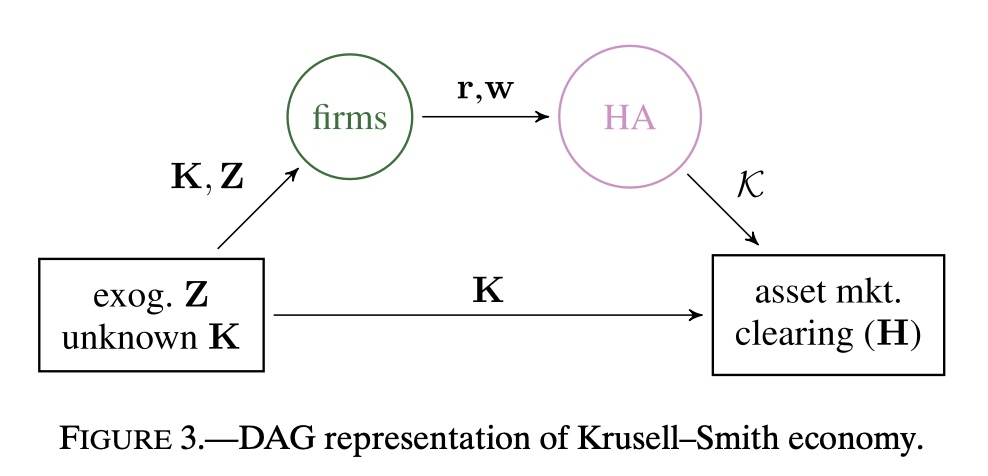

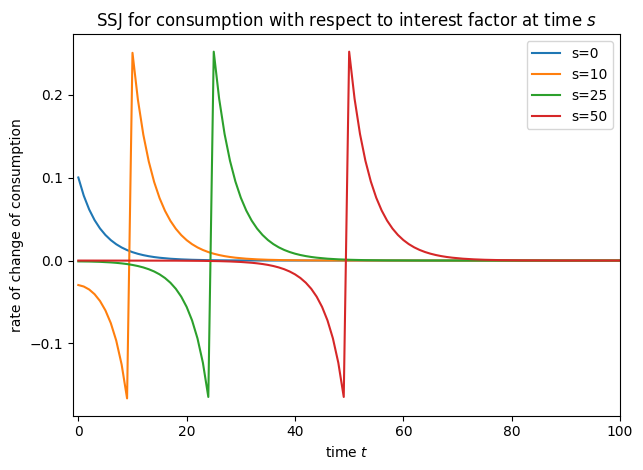

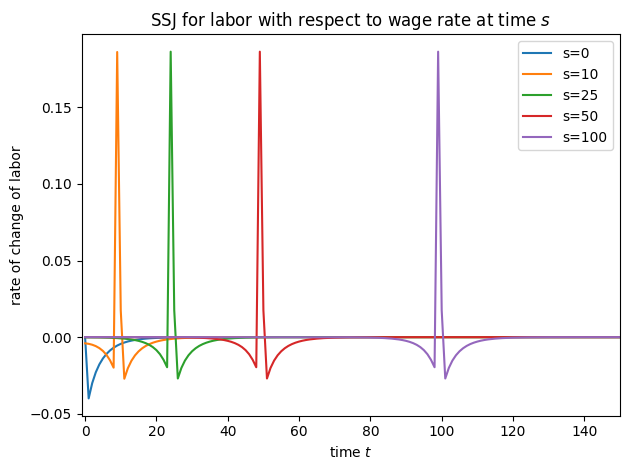

The Sequence Space Jacobian (SSJ) method

Making HA-SSJ Matrices with HARK

Advanced Examples of HA-SSJ’s

Journey: Economics PhD Student

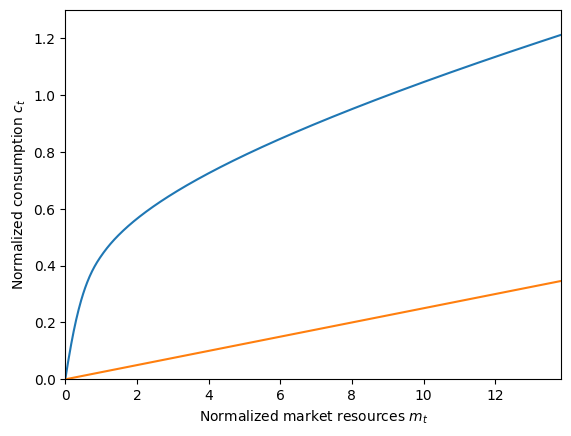

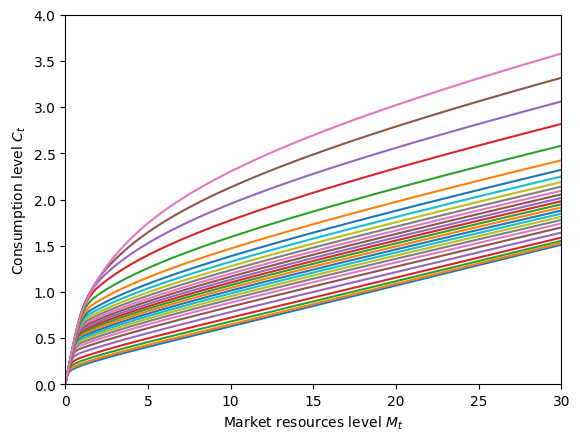

Consumption-Saving Models

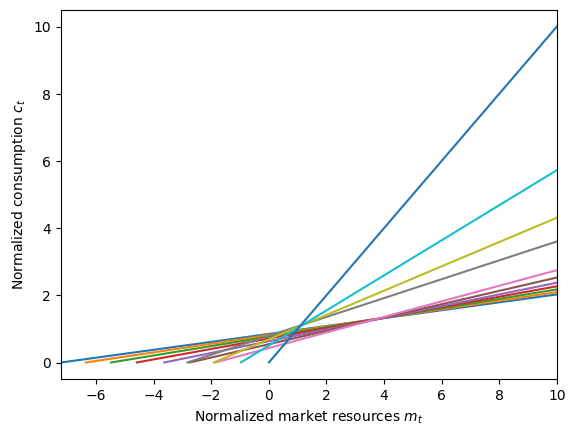

Perfect Foresight Model

Tractable Buffer Stock Model

Representative Agent Models

Permanent and Transitory Income Shocks

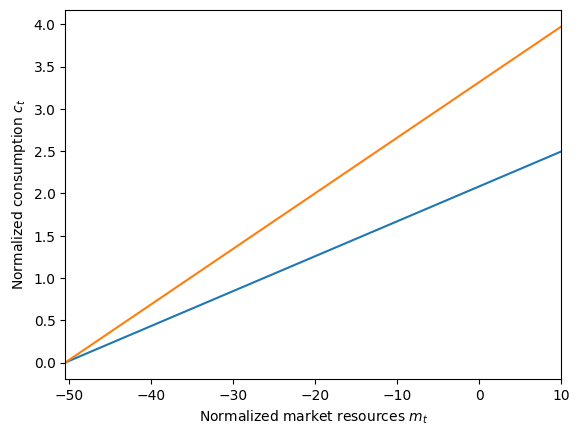

Higher Interest Rate to Borrow than Save

Discrete State with Markov Transitions

Generalized Income Process

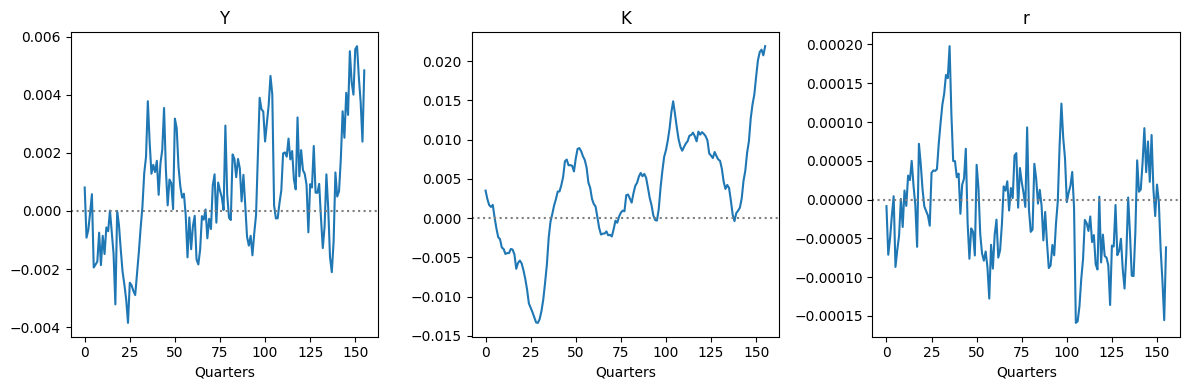

Aggregate Productivity Shocks

Warm-Glow Bequest Motive

Warm-Glow Bequest Motive and Portfolio Choice

Wealth-in-Utility Multiplicatively with Consumption

Wealth-in-Utility Additively with Consumption

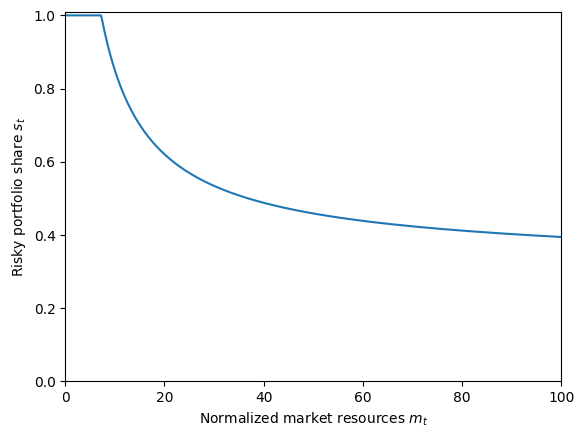

Assets with Risky Returns: Portfolio Choice

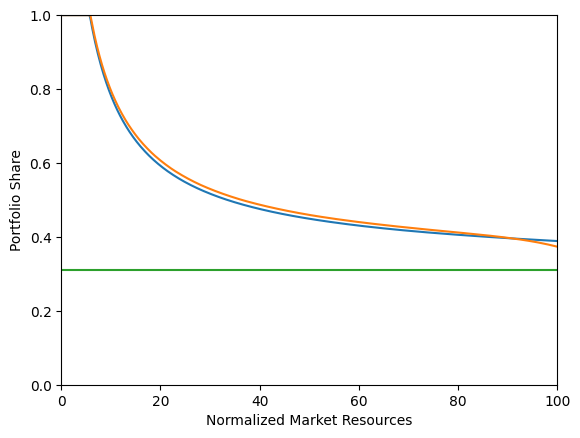

Advanced Options for Portfolio Allocation

Portfolio Allocation with “Sequential Solvers”

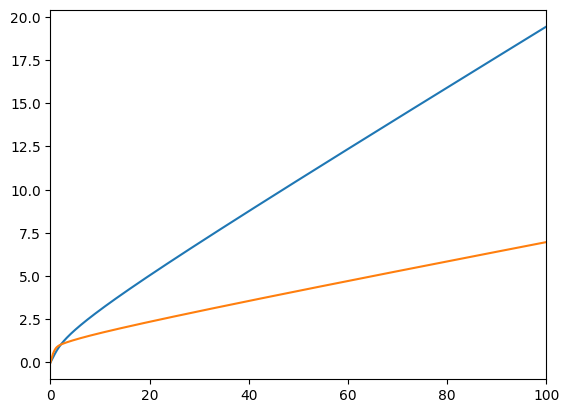

Multiplicative Wealth-in-Utility with Portfolio Choice

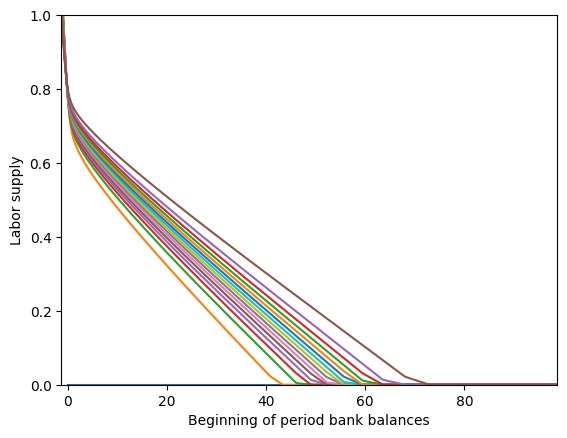

Intensive Margin Labor Supply Choice

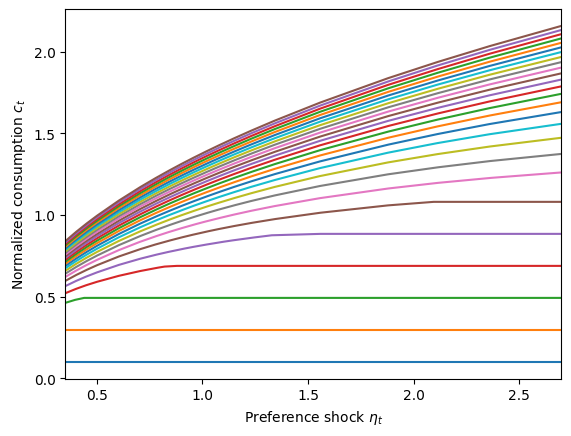

Preference Shocks to Consumption Utility

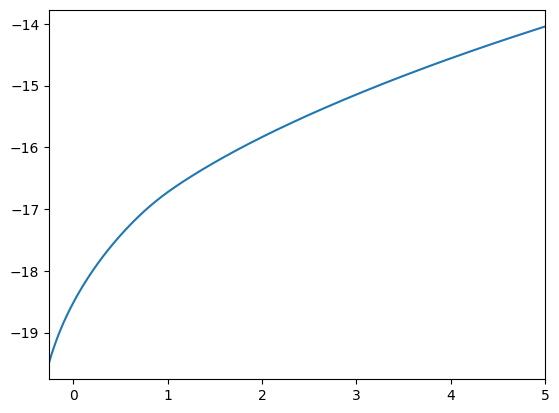

Basic Health Investment

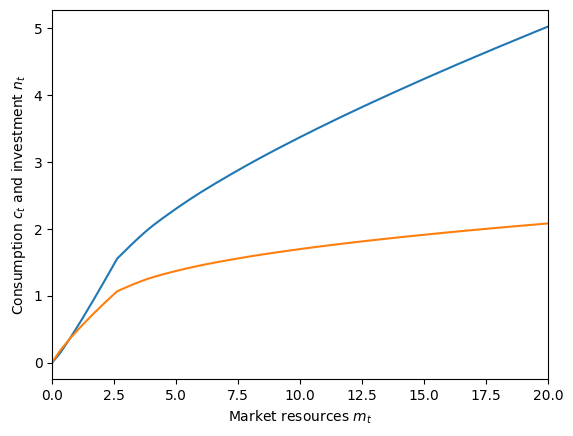

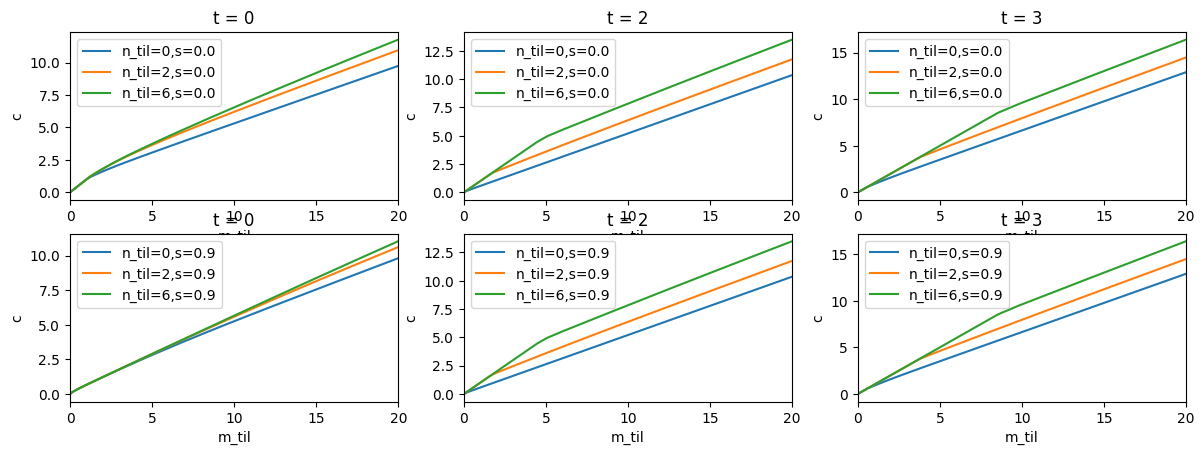

Medical Care on the Intensive Margin

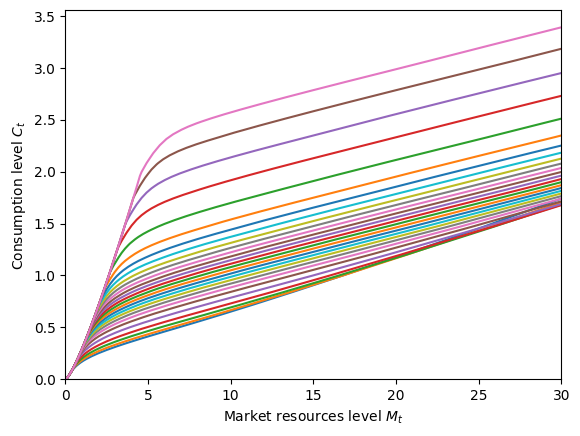

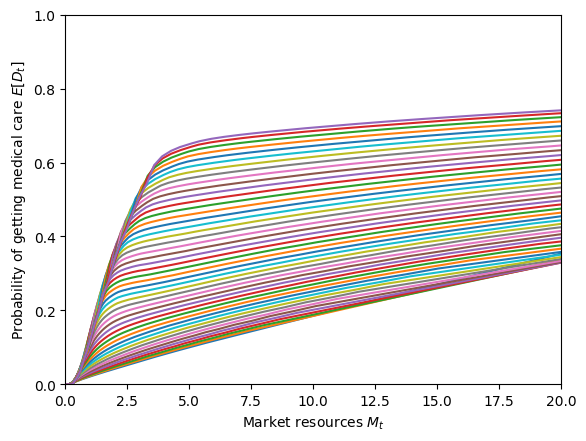

Medical Care on the Extensive Margin

“Risky Contribution” Model

Examples