This page was generated from

examples/TractableBufferStockModel/TractableConsumerType.ipynb.

Interactive online version: .

Download notebook.

.

Download notebook.

Interactive online version:

Tractable Buffer Stock Model#

[1]:

# Import needed tools

from time import time # timing utility

import numpy as np # numeric Python

import matplotlib.pyplot as plt

from HARK.ConsumptionSaving.ConsMarkovModel import (

MarkovConsumerType, # An alternative, much longer way to solve the TBS model

)

from HARK.ConsumptionSaving.TractableBufferStockModel import TractableConsumerType

from HARK.distributions import DiscreteDistributionLabeled

from HARK.utilities import plot_funcs # basic plotting tools

do_simulation = True

[2]:

# Define the model primitives

base_primitives = {

"UnempPrb": 0.00625, # Probability of becoming unemployed

"DiscFac": 0.975, # Intertemporal discount factor

"Rfree": 1.01, # Risk-free interest factor on assets

"PermGroFac": 1.0025, # Permanent income growth factor (uncompensated)

"CRRA": 1.0, # Coefficient of relative risk aversion

"AgentCount": 10000, # Number of agents to simulate

"T_sim": 120, # Number of periods to simulate

}

[3]:

# Make and solve a tractable consumer type

ExampleType = TractableConsumerType()

ExampleType.assign_parameters(**base_primitives)

t_start = time()

ExampleType.solve()

t_end = time()

print(

"Solving a tractable consumption-savings model took "

+ str(t_end - t_start)

+ " seconds.",

)

Solving a tractable consumption-savings model took 0.006001949310302734 seconds.

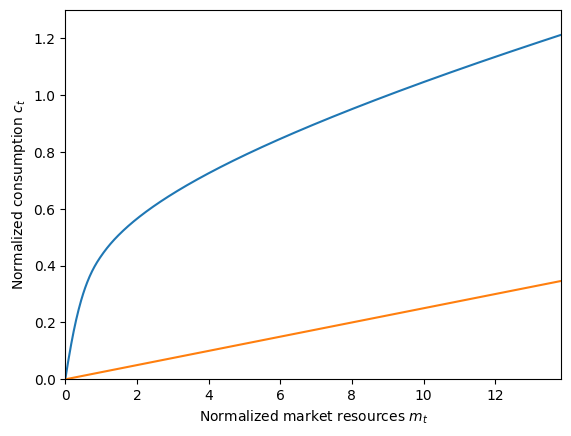

[4]:

# Plot the consumption function and whatnot

m_upper = 1.5 * ExampleType.mTarg

conFunc_PF = lambda m: ExampleType.h * ExampleType.PFMPC + ExampleType.PFMPC * m

# plot_funcs([ExampleType.solution[0].cFunc,ExampleType.mSSfunc,ExampleType.cSSfunc],0,m_upper)

plt.ylim(0.0, 1.3)

plt.xlabel("Normalized market resources $m_t$")

plt.ylabel(r"Normalized consumption $c_t$")

plot_funcs([ExampleType.solution[0].cFunc, ExampleType.solution[0].cFunc_U], 0, m_upper)

[5]:

if do_simulation:

ExampleType.track_vars = ["mNrm"]

ExampleType.make_shock_history()

ExampleType.initialize_sim()

ExampleType.simulate()

[6]:

# Now solve the same model using backward induction rather than the analytic method of TBS.

# The TBS model is equivalent to a Markov model with two states, one of them absorbing (permanent unemployment).

init_consumer_objects = {

"CRRA": base_primitives["CRRA"],

"Rfree": [

np.array(

2 * [base_primitives["Rfree"]],

)

], # Interest factor (same in both states)

"PermGroFac": [

np.array(

2 * [base_primitives["PermGroFac"] / (1.0 - base_primitives["UnempPrb"])],

),

], # Unemployment-compensated permanent growth factor

"BoroCnstArt": None, # Artificial borrowing constraint

"PermShkStd": np.array([[0.0, 0.0]]), # Permanent shock standard deviation

"PermShkCount": 1, # Number of shocks in discrete permanent shock distribution

"TranShkStd": np.array([[0.0, 0.0]]), # Transitory shock standard deviation

"TranShkCount": 1, # Number of shocks in discrete permanent shock distribution

"T_cycle": 1, # Number of periods in cycle

"UnempPrb": np.array(

[[0.0, 0.0]]

), # Unemployment probability (not used, as the unemployment here is *permanent*, not transitory)

"UnempPrbRet": None, # Unemployment probability when retired (irrelevant here)

"T_retire": 0, # Age at retirement (turned off)

"IncUnemp": np.array([[0.0, 0.0]]), # Income when unemployed (irrelevant)

"IncUnempRet": None, # Income when unemployed and retired (irrelevant)

"aXtraMin": 0.001, # Minimum value of assets above minimum in grid

"aXtraMax": ExampleType.mUpperBnd, # Maximum value of assets above minimum in grid

"aXtraCount": 48, # Number of points in assets grid

"aXtraExtra": None, # Additional points to include in assets grid

"aXtraNestFac": 3, # Degree of exponential nesting when constructing assets grid

"LivPrb": [np.array([1.0, 1.0])], # Survival probability

"DiscFac": base_primitives["DiscFac"], # Intertemporal discount factor

"AgentCount": 1, # Number of agents in a simulation (irrelevant)

"tax_rate": 0.0, # Tax rate on labor income (irrelevant)

"vFuncBool": False, # Whether to calculate the value function

"CubicBool": True, # Whether to use cubic splines (False --> linear splines)

"Mrkv_p11": [

1.0 - base_primitives["UnempPrb"]

], # Define the two state, absorbing unemployment Markov array

"Mrkv_p22": [1.0], # Define the two state, absorbing unemployment Markov array

}

MarkovType = MarkovConsumerType(**init_consumer_objects) # Make a basic consumer type

[7]:

employed_income_dist = DiscreteDistributionLabeled(

pmv=np.ones(1),

atoms=np.array([[1.0], [1.0]]),

var_names=["PermShk", "TranShk"],

) # Income distribution when employed

unemployed_income_dist = DiscreteDistributionLabeled(

pmv=np.ones(1),

atoms=np.array([[1.0], [0.0]]),

var_names=["PermShk", "TranShk"],

) # Income distribution when permanently unemployed

[8]:

MarkovType.IncShkDstn = [

[employed_income_dist, unemployed_income_dist],

] # set the income distribution in each state

MarkovType.cycles = 0

[9]:

# Solve the "Markov TBS" model

t_start = time()

MarkovType.solve()

t_end = time()

MarkovType.unpack("cFunc")

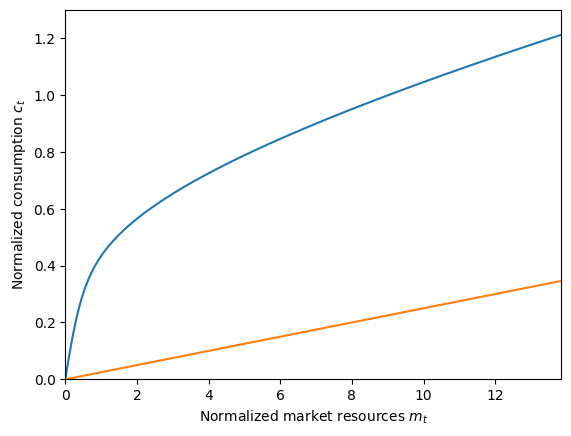

[10]:

print(

'Solving the same model "the long way" took ' + str(t_end - t_start) + " seconds.",

)

# plot_funcs([ExampleType.solution[0].cFunc,ExampleType.solution[0].cFunc_U],0,m_upper)

plt.ylim(0.0, 1.3)

plt.xlabel("Normalized market resources $m_t$")

plt.ylabel(r"Normalized consumption $c_t$")

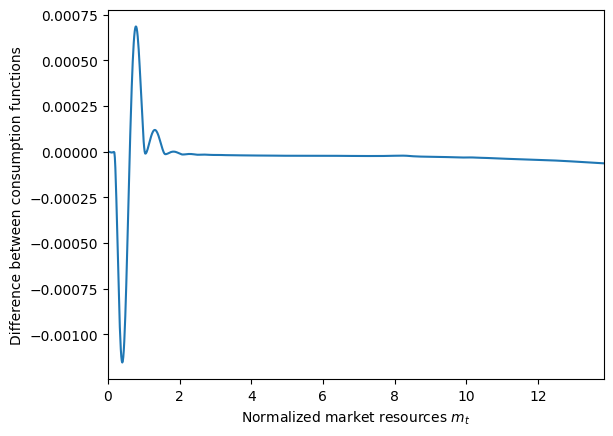

plot_funcs(MarkovType.cFunc[0], 0, m_upper)

diffFunc = lambda m: ExampleType.solution[0].cFunc(m) - MarkovType.cFunc[0][0](m)

plt.xlabel("Normalized market resources $m_t$")

plt.ylabel(r"Difference between consumption functions")

plot_funcs(diffFunc, 0, m_upper)

Solving the same model "the long way" took 1.1812794208526611 seconds.

[ ]:

[ ]: