This page was generated from

examples/ConsPortfolioModel/RiskyAssetConsumerType.ipynb.

Interactive online version: .

Download notebook.

.

Download notebook.

Interactive online version:

Assets with Risky Returns: Portfolio Choice#

[1]:

from time import time

from HARK.ConsumptionSaving.ConsIndShockModel import (

IndShockConsumerType,

IndShockConsumerType_constructors_default,

)

from HARK.ConsumptionSaving.ConsPortfolioModel import (

PortfolioConsumerType,

init_portfolio,

)

from HARK.ConsumptionSaving.ConsRiskyAssetModel import (

RiskyAssetConsumerType,

IndShockRiskyAssetConsumerType_constructor_default,

)

from HARK.utilities import plot_funcs, plot_funcs_der

import matplotlib.pyplot as plt

[2]:

mystr = lambda number: f"{number:.4f}"

Idiosyncratic Income Shocks Consumer Type#

[3]:

# Make a dictionary for the idiosyncratic shocks type that uses common values from the portfolio type

common_dict = init_portfolio.copy()

common_dict["constructors"] = IndShockConsumerType_constructors_default

common_dict["CRRA"] = 5.0 # but make them pretty risk averse

[4]:

# Make and solve an example consumer with idiosyncratic income shocks

# Use init_portfolio parameters to compare to results of PortfolioConsumerType

IndShockExample = IndShockConsumerType(**common_dict)

IndShockExample.cycles = 0 # Make this type have an infinite horizon

[5]:

start_time = time()

IndShockExample.solve()

end_time = time()

print(

"Solving a consumer with idiosyncratic shocks took "

+ mystr(end_time - start_time)

+ " seconds.",

)

IndShockExample.unpack("cFunc")

Solving a consumer with idiosyncratic shocks took 0.4361 seconds.

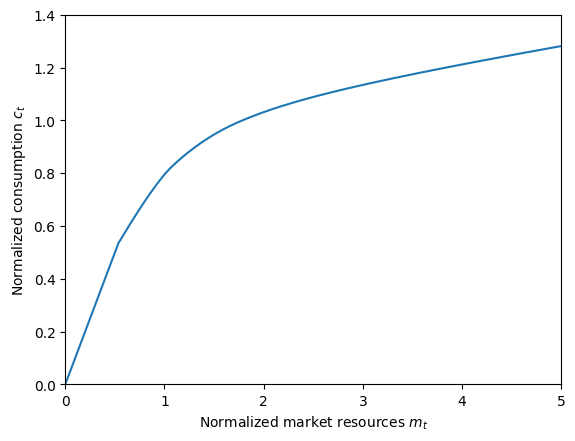

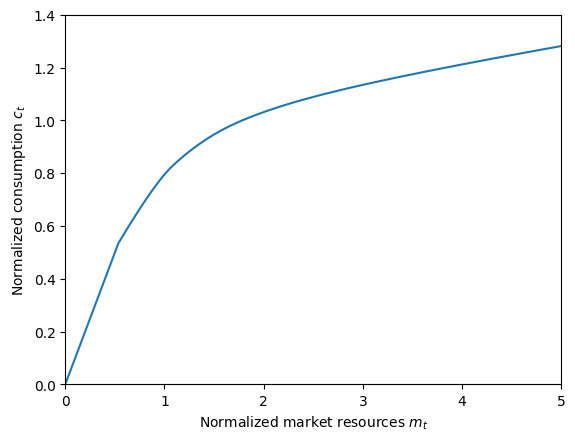

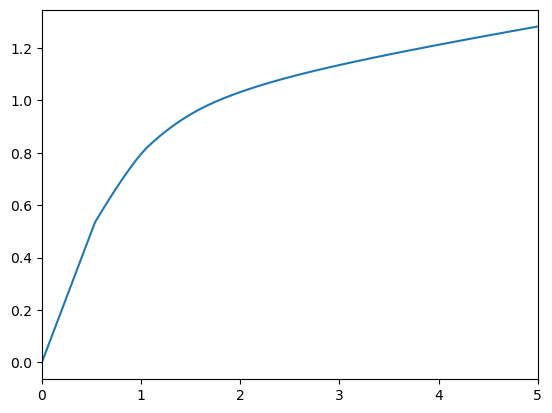

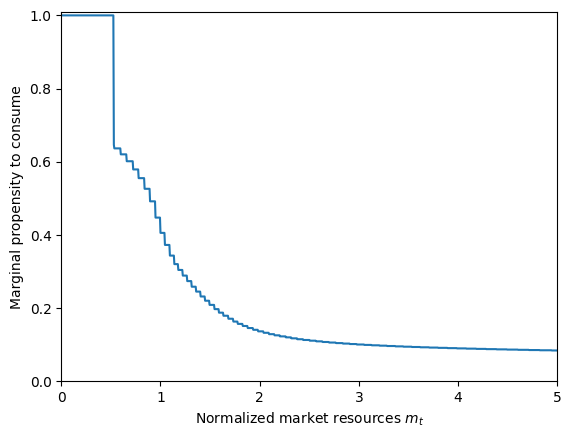

[6]:

# Plot the consumption function and MPC for the infinite horizon consumer

plt.xlabel(r"Normalized market resources $m_t$")

plt.ylabel(r"Normalized consumption $c_t$")

plt.ylim(0.0, 1.4)

plot_funcs(IndShockExample.cFunc[0], 0.0, 5.0)

plt.xlabel(r"Normalized market resources $m_t$")

plt.ylabel(r"Marginal propensity to consume")

plt.ylim(0.0, 1.01)

plot_funcs_der(IndShockExample.cFunc[0], 0.0, 5.0)

Risky Return Consumer Type#

[7]:

# Make and solve an example consumer with risky returns to savings

# Use init_portfolio parameters to compare to results of PortfolioConsumerType

temp_dict = common_dict.copy()

temp_dict["constructors"] = IndShockRiskyAssetConsumerType_constructor_default

RiskyReturnExample = RiskyAssetConsumerType(**temp_dict)

RiskyReturnExample.cycles = 0 # Make this type have an infinite horizon

[8]:

start_time = time()

RiskyReturnExample.solve()

end_time = time()

print(

"Solving a consumer with risky returns took "

+ mystr(end_time - start_time)

+ " seconds.",

)

RiskyReturnExample.unpack("cFunc")

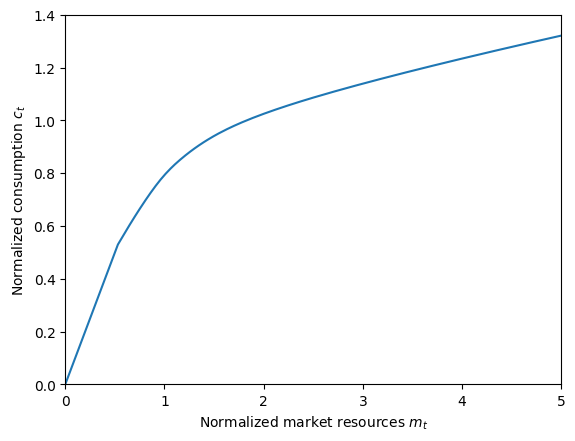

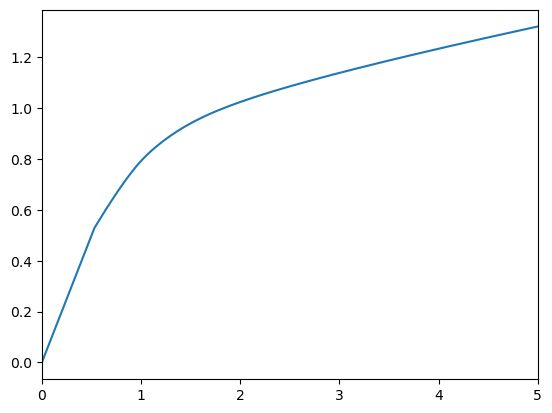

Solving a consumer with risky returns took 3.4542 seconds.

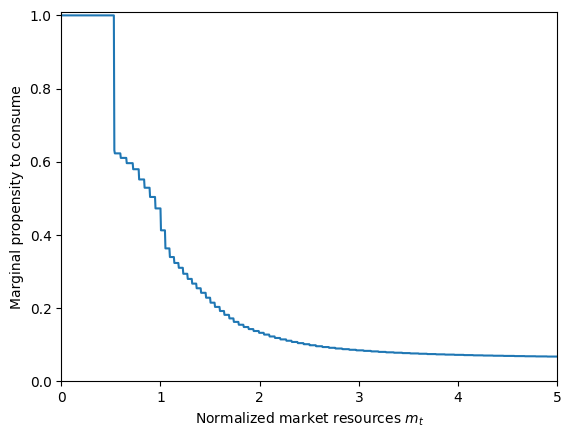

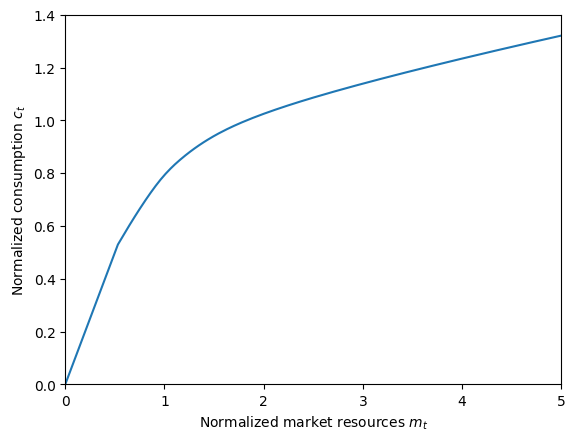

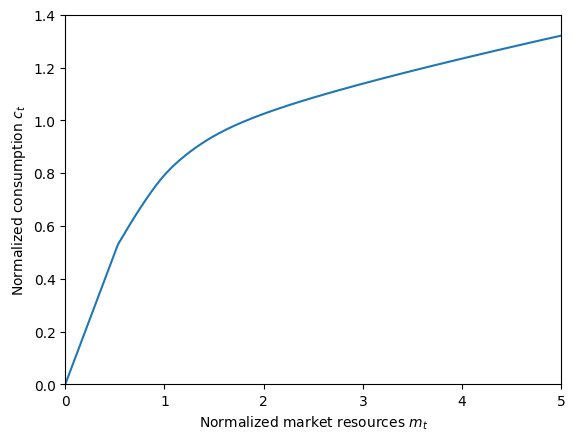

[9]:

# Plot the consumption function and MPC for the risky asset consumer

plt.xlabel(r"Normalized market resources $m_t$")

plt.ylabel(r"Normalized consumption $c_t$")

plt.ylim(0.0, 1.4)

plot_funcs(RiskyReturnExample.cFunc[0], 0.0, 5.0)

plt.xlabel(r"Normalized market resources $m_t$")

plt.ylabel(r"Marginal propensity to consume")

plt.ylim(0.0, 1.01)

plot_funcs_der(RiskyReturnExample.cFunc[0], 0.0, 5.0)

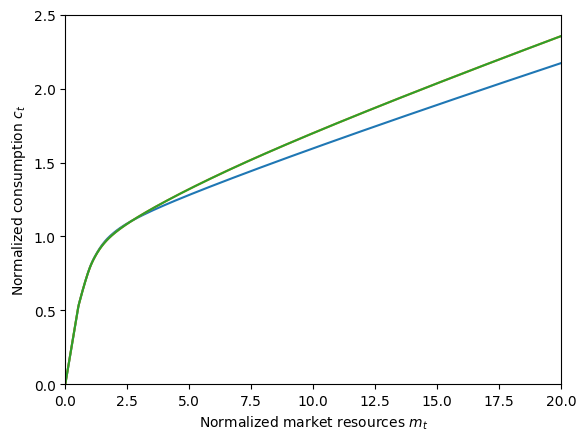

Compare Idiosyncratic Income Shocks with Risky Return#

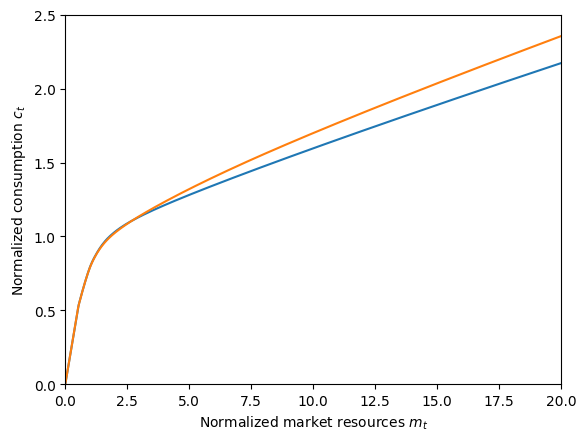

[10]:

# Compare the consumption functions for the various agents in this notebook.

plt.xlabel(r"Normalized market resources $m_t$")

plt.ylabel(r"Normalized consumption $c_t$")

plt.ylim(0.0, 2.5)

plot_funcs(

[

IndShockExample.cFunc[0], # blue

RiskyReturnExample.cFunc[0], # orange

],

0.0,

20.0,

)

Risky Return Consumer Type with Portfolio Choice#

[11]:

# Make and solve an example risky consumer with a portfolio choice

temp_dict["PortfolioBool"] = True

PortfolioChoiceExample = RiskyAssetConsumerType(**temp_dict)

PortfolioChoiceExample.cycles = 0 # Make this type have an infinite horizon

[12]:

start_time = time()

PortfolioChoiceExample.solve()

end_time = time()

print(

"Solving a consumer with risky returns and portfolio choice took "

+ mystr(end_time - start_time)

+ " seconds.",

)

PortfolioChoiceExample.unpack("cFunc")

PortfolioChoiceExample.unpack("ShareFunc")

Solving a consumer with risky returns and portfolio choice took 3.4221 seconds.

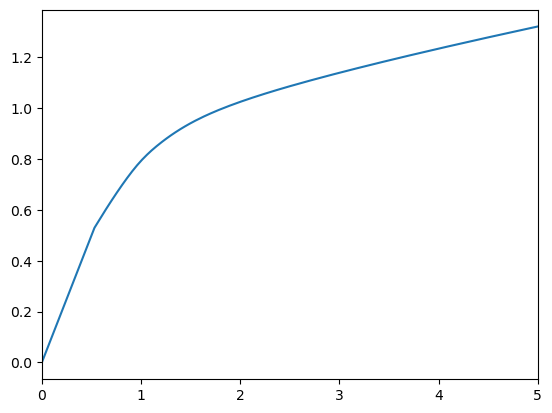

[13]:

# Plot the consumption function and MPC for the portfolio choice consumer

plt.xlabel(r"Normalized market resources $m_t$")

plt.ylabel(r"Normalized consumption $c_t$")

plt.ylim(0.0, 1.4)

plot_funcs(PortfolioChoiceExample.cFunc, 0.0, 5.0)

plt.xlabel(r"Normalized market resources $m_t$")

plt.ylabel(r"Marginal propensity to consume")

plt.ylim(0.0, 1.01)

plot_funcs_der(PortfolioChoiceExample.cFunc, 0.0, 5.0)

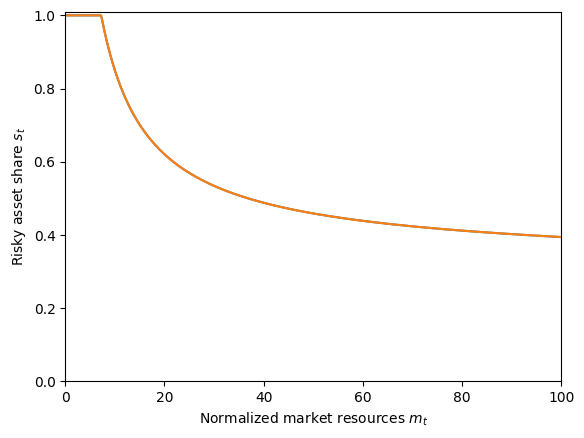

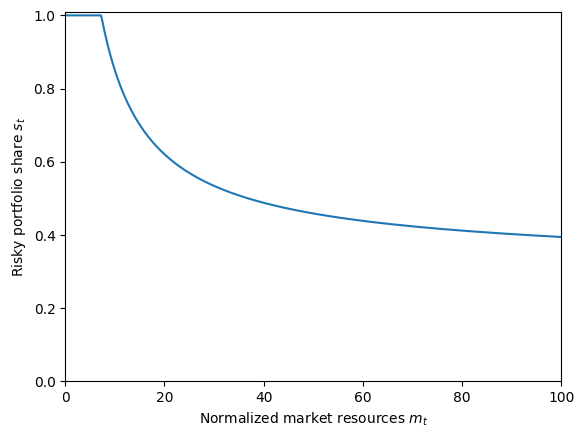

[14]:

plt.xlabel(r"Normalized market resources $m_t$")

plt.ylabel(r"Risky portfolio share $s_t$")

plt.ylim(0.0, 1.01)

plot_funcs(PortfolioChoiceExample.ShareFunc, 0.0, 100.0)

Compare Income Shocks, Risky Return, and RR w/ Portfolio Choice#

[15]:

# Compare the consumption functions for the various agents in this notebook.

plt.xlabel(r"Normalized market resources $m_t$")

plt.ylabel(r"Normalized consumption $c_t$")

plt.ylim(0.0, 2.5)

plot_funcs(

[

IndShockExample.cFunc[0], # blue

RiskyReturnExample.cFunc[0], # orange

PortfolioChoiceExample.cFunc[0], # green

],

0.0,

20.0,

)

Portfolio Consumer Type#

[16]:

# Make and solve an example portfolio choice consumer

PortfolioTypeExample = PortfolioConsumerType(

CRRA=5.0

) # default parameters with higher risk aversion

PortfolioTypeExample.cycles = 0 # Make this type has an infinite horizon

[17]:

start_time = time()

PortfolioTypeExample.solve()

end_time = time()

print(

"Solving a consumer with portfolio choice took "

+ mystr(end_time - start_time)

+ " seconds.",

)

PortfolioTypeExample.unpack("cFuncAdj")

PortfolioTypeExample.unpack("ShareFuncAdj")

Solving a consumer with portfolio choice took 10.4243 seconds.

[18]:

# Plot the consumption function and MPC for the portfolio choice consumer

plt.xlabel(r"Normalized market resources $m_t$")

plt.ylabel(r"Normalized consumption $c_t$")

plt.ylim(0.0, 1.4)

plot_funcs(PortfolioTypeExample.cFuncAdj[0], 0.0, 5.0)

plt.xlabel(r"Normalized market resources $m_t$")

plt.ylabel(r"Marginal propensity to consume")

plt.ylim(0.0, 1.01)

plot_funcs_der(PortfolioTypeExample.cFuncAdj[0], 0.0, 5.0)

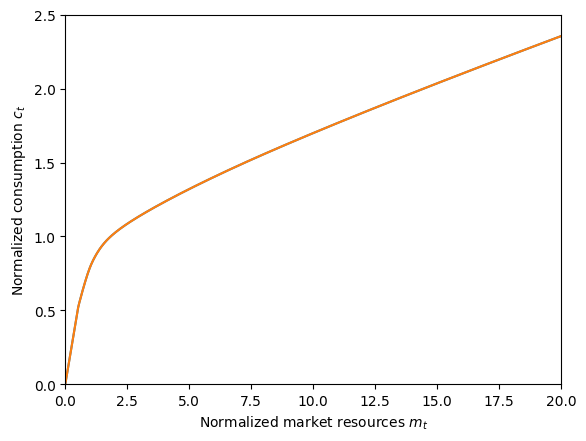

Compare RR w/ Portfolio Choice vs Portfolio Choice Type#

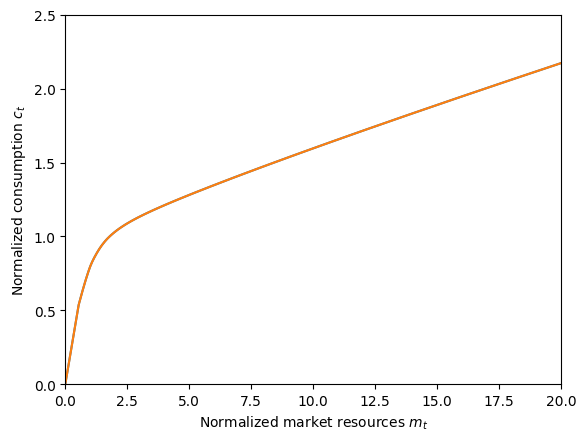

[19]:

# Compare the consumption functions for the various portfolio choice types.

plt.xlabel(r"Normalized market resources $m_t$")

plt.ylabel(r"Normalized consumption $c_t$")

plt.ylim(0.0, 2.5)

plot_funcs(

[

PortfolioTypeExample.cFuncAdj[0], # blue

PortfolioChoiceExample.cFunc[0], # orange

],

0.0,

20.0,

)

[20]:

# Compare the share functions for the various portfolio choice types.

plt.xlabel(r"Normalized market resources $m_t$")

plt.ylabel(r"Risky asset share $s_t$")

plt.ylim(0.0, 1.01)

plot_funcs(

[

PortfolioTypeExample.ShareFuncAdj[0], # blue

PortfolioChoiceExample.ShareFunc[0], # orange

],

0,

100,

)