This page was generated from

examples/ConsPortfolioModel/SequentialPortfolioConsumerType.ipynb.

Interactive online version: .

Download notebook.

.

Download notebook.

Interactive online version:

Portfolio Allocation with “Sequential Solvers”#

[1]:

"""Example implementations of SequentialPortfolioConsumerType

"""

from time import time

import matplotlib.pyplot as plt

import numpy as np

from HARK.ConsumptionSaving.ConsPortfolioModel import init_portfolio

from HARK.ConsumptionSaving.ConsSequentialPortfolioModel import (

SequentialPortfolioConsumerType,

)

from HARK.utilities import plot_funcs

SequentialPortfolioConsumerType Example Implementation#

[2]:

# Make and solve an example portfolio choice consumer type

print("Now solving an example portfolio choice problem; this might take a moment...")

MyType = SequentialPortfolioConsumerType()

MyType.cycles = 0

t0 = time()

MyType.solve()

t1 = time()

MyType.cFunc = [MyType.solution[t].cFuncAdj for t in range(MyType.T_cycle)]

MyType.ShareFunc = [MyType.solution[t].ShareFuncAdj for t in range(MyType.T_cycle)]

MyType.SequentialShareFunc = [

MyType.solution[t].SequentialShareFuncAdj for t in range(MyType.T_cycle)

]

print(

"Solving an infinite horizon portfolio choice problem took "

+ str(t1 - t0)

+ " seconds.",

)

Now solving an example portfolio choice problem; this might take a moment...

Solving an infinite horizon portfolio choice problem took 10.279305696487427 seconds.

[3]:

# Plot the consumption and risky-share functions

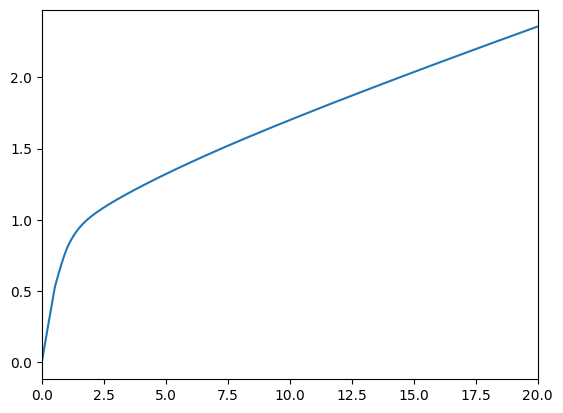

print("Consumption function over market resources:")

plot_funcs(MyType.cFunc[0], 0.0, 20.0)

Consumption function over market resources:

[4]:

# Since we are using a discretization of the lognormal distribution,

# the limit is numerically computed and slightly different from

# the analytical limit obtained by Merton and Samuelson for infinite wealth

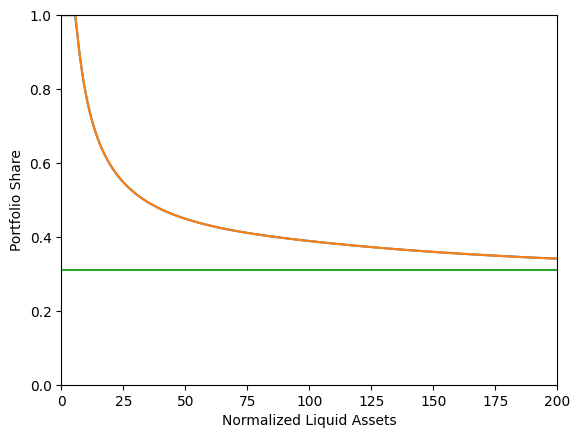

print("Risky asset share as a function of liquid assets:")

print("Optimal (blue/orange) versus Theoretical Limit (green)")

plt.xlabel("Normalized Liquid Assets")

plt.ylabel("Portfolio Share")

plt.ylim(0.0, 1.0)

plt.xlim(0.0, 200.0)

mgrid = np.linspace(0.0, 300.0, 300)

cgrid = MyType.cFunc[0](mgrid)

shares = MyType.ShareFunc[0](mgrid)

agrid = mgrid - cgrid

plt.plot(agrid, shares)

plot_funcs(

[

MyType.SequentialShareFunc[0],

lambda a: MyType.ShareLimit[0] * np.ones_like(a),

],

0.0,

200.0,

)

# Note that the orange line lies right on top of the blue line and they are basically

# indistinguishable. This is expected, as deciding saving and risky share simultaneously

# should give the same result as when doing it sequentially.

Risky asset share as a function of liquid assets:

Optimal (blue/orange) versus Theoretical Limit (green)

[5]:

print("\n\n\n")

print("For derivation of the numerical limiting portfolio share")

print("as market resources approach infinity, see")

print(

"https://www.econ2.jhu.edu/people/ccarroll/public/lecturenotes/AssetPricing/Portfolio-CRRA/",

)

For derivation of the numerical limiting portfolio share

as market resources approach infinity, see

https://www.econ2.jhu.edu/people/ccarroll/public/lecturenotes/AssetPricing/Portfolio-CRRA/

[6]:

print("\n\n\n")

[7]:

""

# Make another example type, but this one can only update their risky portfolio

# share in any particular period with 15% probability.

init_sticky_share = init_portfolio.copy()

init_sticky_share["AdjustPrb"] = 0.15

[8]:

# Make and solve a discrete portfolio choice consumer type

print(

'Now solving a portfolio choice problem with "sticky" portfolio shares; this might take a moment...',

)

StickyType = SequentialPortfolioConsumerType(**init_sticky_share)

StickyType.cycles = 0

t0 = time()

StickyType.solve()

t1 = time()

StickyType.cFuncAdj = [

StickyType.solution[t].cFuncAdj for t in range(StickyType.T_cycle)

]

StickyType.cFuncFxd = [

StickyType.solution[t].cFuncFxd for t in range(StickyType.T_cycle)

]

StickyType.ShareFunc = [

StickyType.solution[t].ShareFuncAdj for t in range(StickyType.T_cycle)

]

StickyType.SequentialShareFunc = [

StickyType.solution[t].SequentialShareFuncAdj for t in range(StickyType.T_cycle)

]

print(

"Solving an infinite horizon sticky portfolio choice problem took "

+ str(t1 - t0)

+ " seconds.",

)

Now solving a portfolio choice problem with "sticky" portfolio shares; this might take a moment...

Solving an infinite horizon sticky portfolio choice problem took 26.704002380371094 seconds.

[9]:

# Plot the consumption and risky-share functions

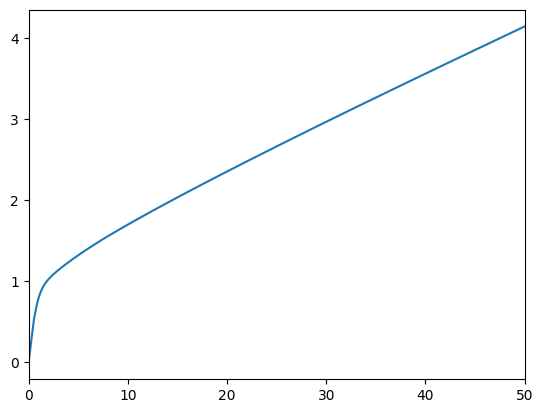

print(

"Consumption function over market resources when the agent can adjust his portfolio:",

)

plot_funcs(StickyType.cFuncAdj[0], 0.0, 50.0)

Consumption function over market resources when the agent can adjust his portfolio:

[10]:

print(

"Consumption function over market resources when the agent CAN'T adjust, by current share:",

)

M = np.linspace(0.0, 50.0, 100)

for s in np.linspace(0.0, 1.0, 5):

C = StickyType.cFuncFxd[0](M, s * np.ones_like(M))

plt.plot(M, C)

plt.xlim(0.0, 50.0)

plt.ylim(0.0, None)

plt.show()

Consumption function over market resources when the agent CAN'T adjust, by current share:

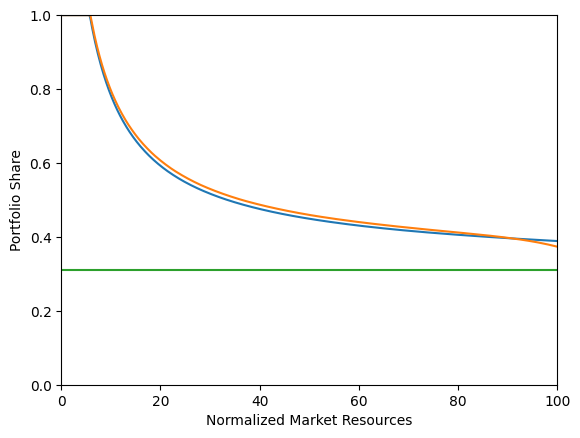

[12]:

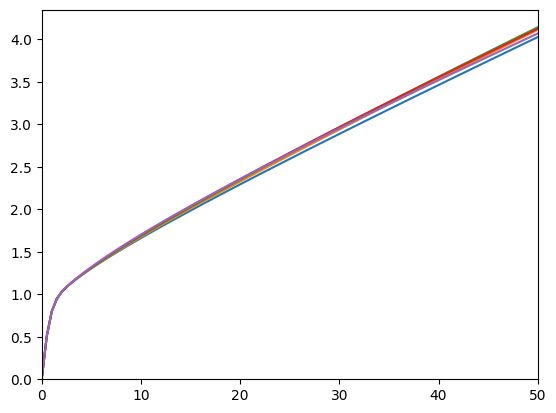

print("Risky asset share function over market resources (when possible to adjust):")

print("Optimal (blue/orange) versus Theoretical Limit (green)")

plt.xlabel("Normalized Market Resources")

plt.ylabel("Portfolio Share")

plt.ylim(0.0, 1.0)

mgrid = np.linspace(0.0, 200.0, 1000)

cgrid = MyType.cFunc[0](mgrid)

shares = MyType.ShareFunc[0](mgrid)

agrid = mgrid - cgrid

plt.plot(agrid, shares)

plot_funcs(

[

StickyType.SequentialShareFunc[0],

lambda a: StickyType.ShareLimit[0] * np.ones_like(a),

],

0.0,

100.0,

)

Risky asset share function over market resources (when possible to adjust):

Optimal (blue/orange) versus Theoretical Limit (green)

[ ]: