Interactive online version:

Solving Krusell Smith Model with HARK and SSJ#

By William Du

[1]:

import time

import matplotlib.pyplot as plt

import numpy as np

from scipy import optimize

from sequence_jacobian import create_model, simple # functions

from sequence_jacobian.classes import JacobianDict, SteadyStateDict

from HARK.ConsumptionSaving.ConsNewKeynesianModel import NewKeynesianConsumerType

Calibration and setup#

This notebook uses the HARK toolkit to solve Krusell and Smith (1998), applying the Sequence Space Jacobian and SSJ toolkit.

Firm setup#

Collect calibration for the production economy in a dictionary.

[2]:

calibration = {

"eis": 1, # Elasticity of intertemporal substitution

"delta": 0.025, # Depreciation rate

"alpha": 0.11, # Capital share of income

"L_ss": 1.0, # Steady state labor

"Y_ss": 1.0, # Steady state output

"r_ss": 0.01, # Steady state real interest rate

}

Steady State Capital#

Find steady state capital (K_ss) and productivity (Z) implied by the firm’s first order condition, aggregate resource constraint and the above steady state values of labor (L_ss), the real interest rate (r_ss) and output (Y_ss).

[3]:

from scipy.optimize import root

def your_funcs(X):

L_ss = calibration["L_ss"]

alpha = calibration["alpha"]

delta = calibration["delta"]

r_ss = calibration["r_ss"]

Y_ss = calibration["Y_ss"]

K, Z = X

# Firms first order condition and aggregate resource constraint

f = [

alpha * Z * (K / L_ss) ** (alpha - 1) - delta - r_ss, # r_ss = MPK

Z * K**alpha * L_ss ** (1 - alpha) - Y_ss, # Y = Z*F(K,L)

]

return f

sol = root(your_funcs, [1.0, 1.0]) # find roots

K_ss, Z_ss = sol.x

calibration["K_ss"] = K_ss

calibration["Z_ss"] = Z_ss

[4]:

print(sol)

message: The solution converged.

success: True

status: 1

fun: [ 1.749e-14 -5.218e-15]

x: [ 3.143e+00 8.816e-01]

method: hybr

nfev: 14

fjac: [[-3.675e-01 9.300e-01]

[-9.300e-01 -3.675e-01]]

r: [ 3.906e-02 1.143e+00 -3.236e-01]

qtf: [-4.533e-12 -5.621e-12]

Double check the roots we find produce our chosen steady state values.

[5]:

def firm(

K,

Z,

L_ss=calibration["L_ss"],

alpha=calibration["alpha"],

delta=calibration["delta"],

):

r = alpha * Z * (K / L_ss) ** (alpha - 1) - delta

w = (1 - alpha) * Z * (K / L_ss) ** alpha

Y = Z * K**alpha * L_ss ** (1 - alpha)

return r, w, Y

r_ss, w_ss, Y_ss = firm(sol.x[0], sol.x[1])

calibration["w_ss"] = w_ss

[6]:

print("--------------------------------------+------------")

print(f"Steady state capital | {K_ss:.4f}")

print(f"Steady state output | {Y_ss:.4f}")

print(f"Steady state real interest rate | {r_ss:.4f}")

print(f"Steady state wage | {w_ss:.4f}")

print("--------------------------------------+------------")

--------------------------------------+------------

Steady state capital | 3.1429

Steady state output | 1.0000

Steady state real interest rate | 0.0100

Steady state wage | 0.8900

--------------------------------------+------------

HARK agent#

HARK represents agent problems where aggregate variables can affect an individual income process as instances of NewKeynesianConsumerType, a subclass of AgentType (see A Gentle Introduction to HARK).

Instances of the NewKeynesianConsumerType class contain functions that solve policy functions of optimizing agents and compute Jacobian matrices in response to a policy shocks using the SSJ toolkit.

NOTE: NewKeynesianConsumerType is still a microeconomic agent solving an income fluctuation problem. The only difference from `IndShockConsumerType <https://docs.econ-ark.org/examples/HowWeSolveIndShockConsumerType/HowWeSolveIndShockConsumerType.html>`__ is that additional aggregate labour income variables are passed to the agent’s income process. This allows the agent’s problem to be defined within a general equilibrium framework such as (but not restricted to) HANK.

NOTE: Researchers can also create their own agent types by subclassing AgentType. See HARK’s documentation for more information.

To create an instance of NewKeynesianConsumerType, first specify parameters in a dictionary. To start, we use a discount factor of 0.98.

[7]:

L_ss = calibration["L_ss"]

w_ss = calibration["w_ss"]

r_ss = calibration["r_ss"]

HANK_Dict = {

# Individual agent 'preferences' (shared with perfect foresight model)

"CRRA": calibration["eis"], # Coefficient of relative risk aversion

"DiscFac": 0.98, # Intertemporal discount factor

"LivPrb": [0.99375], # Survival probability

# Individual lifcycle income process parameters

"PermGroFac": [1.00], # Permanent income growth factor

"PermShkStd": [0.06], # Standard deviation of log permanent shocks to income

"PermShkCount": 5, # Number of points in discrete approximation to permanent income shocks

"TranShkStd": [0.2], # Standard deviation of log transitory shocks to income

"TranShkCount": 5, # Number of points in discrete approximation to transitory income shocks

# Parameters related to unemployment and retirement

"UnempPrb": 0.0, # Probability of unemployment while working

"IncUnemp": 0.0, # Unemployment benefits replacement rate

"UnempPrbRet": 0.0000, # Probability of "unemployment" while retired

"IncUnempRet": 0.0, # "Unemployment" benefits when retired

"T_retire": 0.0, # Period of retirement (0 --> no retirement)

# Aggregates affecting the agent's decision

"Rfree": [(1 + r_ss)], # Interest factor for assets faced by agents

"wage": [w_ss], # Wage rate faced by agents

"tax_rate": [

0

], # set to 0.0 because we are going to assume that labor here is actually after tax income

"labor": [L_ss], # Aggregate (mean) labor supply

# Parameters for constructing "assets above minimum" grid

"aXtraMin": 0.0001, # Minimum end-of-period "assets above minimum" value

"aXtraMax": 2000, # Maximum end-of-period "assets above minimum" value

"aXtraCount": 200, # Number of points in the base grid of "assets above minimum"

# Exponential nesting factor when constructing "assets above minimum" grid

"aXtraNestFac": 3,

"aXtraExtra": None, # Additional values to add to aXtraGrid

# Transition matrix simulation parameters

"mCount": 200,

"mMax": 2000,

"mMin": 0.0001,

"mFac": 3,

}

Let’s create a temporary instance of a NewKeynesianConsumerType agent.

[8]:

tempAgent = NewKeynesianConsumerType(**HANK_Dict)

Given a discount factor, the agent will supply a steady state capital stock A_ss.

[9]:

A_ss = tempAgent.compute_steady_state()[0]

print(f"Steady state agent asset supply for beta = 0.98 is: {A_ss:.3f}")

Steady state agent asset supply for beta = 0.98 is: 0.231

Steady State Assets#

Since we are interested in computing a steady state equilibrium, we find discFac such that A_ss clears the asset market given that K_ss is the steady state firm capital demand.

[10]:

def A_ss_func(beta):

HANK_Dict["DiscFac"] = beta

# For a given value of beta, we need to re-create the Agent

Agent_func = NewKeynesianConsumerType(**HANK_Dict, verbose=False)

# And then solve for the steady state supply

A_ss = Agent_func.compute_steady_state()[0]

return A_ss

def ss_dif(beta):

return A_ss_func(beta) - Asset_target

start = time.time()

Asset_target = K_ss

DiscFac = optimize.brentq(ss_dif, 0.8, 0.9999)

print(f"Time taken to solve for steady state {time.time() - start:.3f} secs.")

Time taken to solve for steady state 11.408 secs.

We can now create the steady state agent using the general equilibrium discount factor.

[11]:

# Create a new agent

HANK_Dict["DiscFac"] = DiscFac

steadyHANK = NewKeynesianConsumerType(**HANK_Dict, verbose=False)

A_ss, C_ss = steadyHANK.compute_steady_state()

[12]:

# To make sure goods and asset markets clear

print(

"Final goods clearing:",

calibration["Y_ss"] - C_ss - calibration["delta"] * calibration["K_ss"],

)

print("Asset clearing:", A_ss - calibration["K_ss"])

Final goods clearing: 0.019151809710635556

Asset clearing: -4.28052704393167e-10

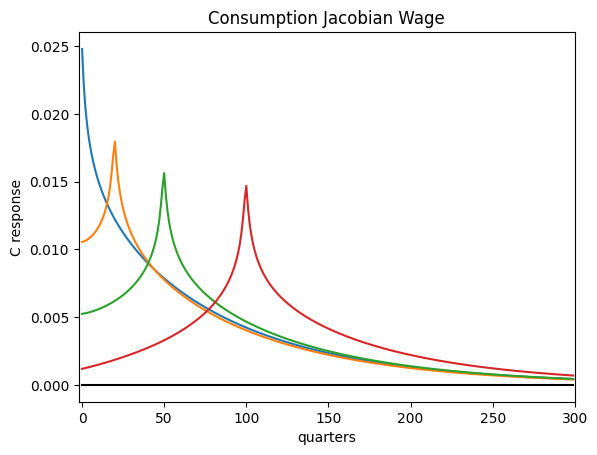

Computing Jacobians using SSJ#

With the steady state agent in hand, we can compute the Jacobians of the steady state HANK agent’s policy with respect to the aggregate state variables.

The calc_jacobian method of our NewKeynesianConsumerType agent computes the Jacobians of the steady state aggregate consumption (CJACW) and assets (AJACW) with respect to a pertubation of a specified variable.

Recall CJACW[s,t] is the time \(t\) response to a shock at time \(s\).

Here is an example where we shock the wage rate.

[13]:

start = time.time()

CJACW, AJACW = steadyHANK.calc_jacobian("wage", 300) # Wage jacobians

print(f"Time taken to compute wage Jacobians: {time.time() - start:.3f} seconds")

Time taken to compute wage Jacobians: 4.084 seconds

[14]:

plt.plot(CJACW.T[0], label="s=0")

plt.plot(CJACW.T[20], label="s=20")

plt.plot(CJACW.T[50], label="s=50")

plt.plot(CJACW.T[100], label="s=100")

plt.xlim(-2, 300)

plt.plot(np.arange(300), np.zeros(300), color="k")

plt.title("Consumption Jacobian (Wage) ")

plt.xlabel("Quarters")

plt.ylabel("Consumption response")

plt.legend()

plt.show()

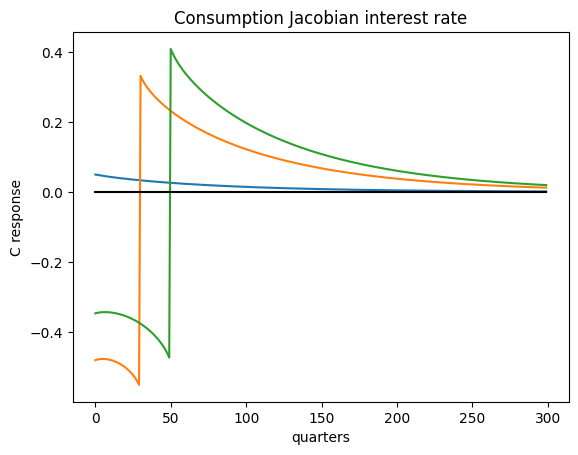

[15]:

start = time.time()

CJACR, AJACR = steadyHANK.calc_jacobian("Rfree", 300) # Rfree jacobians

print(

f"Time taken to compute return factor Jacobians: {time.time() - start:.3f} seconds"

)

Time taken to compute return factor Jacobians: 3.977 seconds

Here is an example where we shock the return factor.

[16]:

plt.plot(CJACR.T[0], label="s =0")

plt.plot(CJACR.T[20], label="s=20")

plt.plot(CJACR.T[50], label="s=50")

plt.plot(CJACR.T[100], label="s=100")

plt.plot(np.arange(300), np.zeros(300), color="k")

plt.title("Consumption Jacobian (Return Factor)")

plt.xlabel("Quarters")

plt.ylabel("Consumption response")

plt.show()

Let’s store the Jacobians in a dictionary for later use.

[17]:

# Store Jacobians in JacobianDict Object

Jacobian_Dict = JacobianDict(

{

"C": {

"w": CJACW,

"r": CJACR,

},

"A": {

"w": AJACW,

"r": AJACR,

},

},

)

# Construct SteadyStateDict object

SteadyState_Dict = SteadyStateDict(

{

"asset_mkt": 0.0,

"goods_mkt": 0.0,

"r": r_ss,

"Y": Y_ss,

"A": K_ss,

"C": C_ss,

"Z": Z_ss,

"delta": calibration["delta"],

"alpha": calibration["alpha"],

"L": L_ss,

"K": K_ss,

"w": w_ss,

},

)

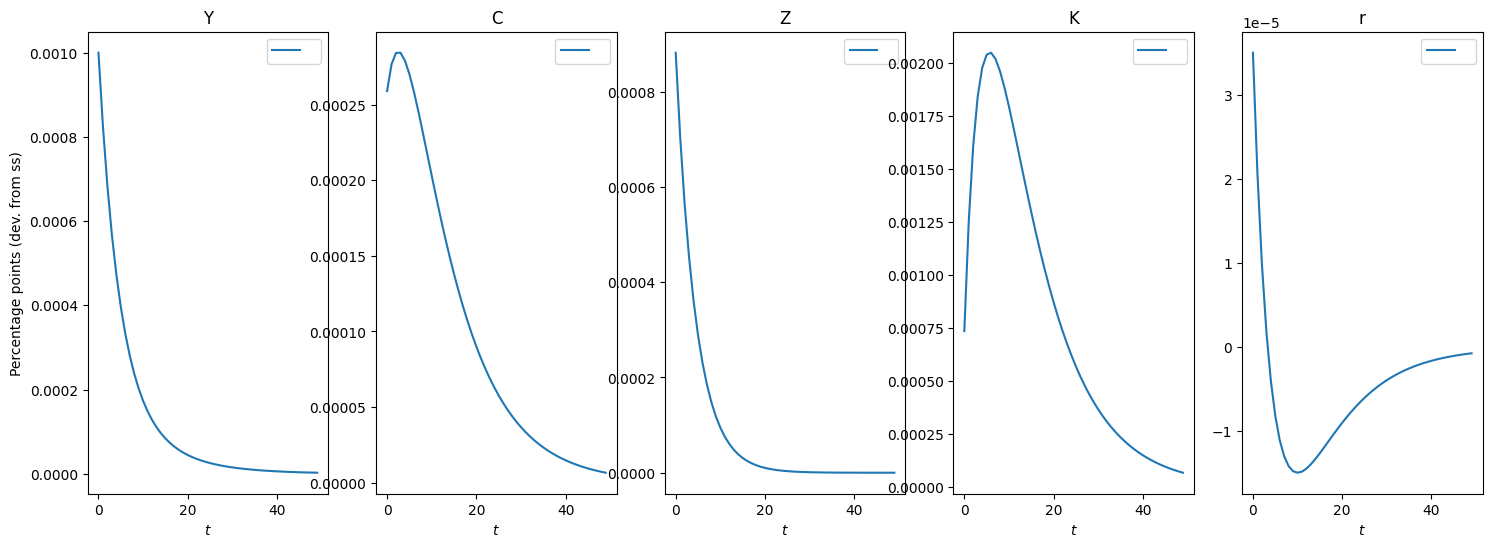

Impulse Response Functions and Simulations#

[18]:

@simple

def firm(K, L, Z, alpha, delta):

r = alpha * Z * (K(-1) / L) ** (alpha - 1) - delta

w = (1 - alpha) * Z * (K(-1) / L) ** alpha

Y = Z * K(-1) ** alpha * L ** (1 - alpha)

return r, w, Y

@simple

def mkt_clearing(K, A, Y, C, delta):

asset_mkt = A - K

goods_mkt = Y - C - delta * K

return asset_mkt, goods_mkt

[19]:

ks = create_model([Jacobian_Dict, firm, mkt_clearing], name="Krusell-Smith")

Solving for Impulse Responses#

[20]:

T = 300 # Length of the IRF

rho_Z = 0.8 # Persistence of IRF shock

dZ = 0.001 * Z_ss * rho_Z ** np.arange(T)

shocks = {"Z": dZ}

inputs = ["Z"]

unknowns = ["K"]

targets = ["asset_mkt"]

irfs_Z = ks.solve_impulse_linear(SteadyState_Dict, unknowns, targets, shocks)

[21]:

def show_irfs(

irfs_list,

variables,

labels=[" "],

ylabel=r"Percentage point (dev. from ss)",

T_plot=50,

figsize=(18, 6),

):

if len(irfs_list) != len(labels):

labels = [" "] * len(irfs_list)

n_var = len(variables)

fig, ax = plt.subplots(1, n_var, figsize=figsize, sharex=True)

for i in range(n_var):

# plot all irfs

for j, irf in enumerate(irfs_list):

ax[i].plot(irf[variables[i]][:50] * 1e2, label=labels[j])

ax[i].set_title(variables[i])

ax[i].set_xlabel(r"Quarters")

if i == 0:

ax[i].set_ylabel(ylabel)

# ax[i].legend()

# ax[i].x

plt.tight_layout()

plt.show()

# plt.savefig("irf.png")

[22]:

# Impulse Responses to Productivity Shock

show_irfs([irfs_Z], ["Y", "C", "Z", "K", "r"])

Simulating the model#

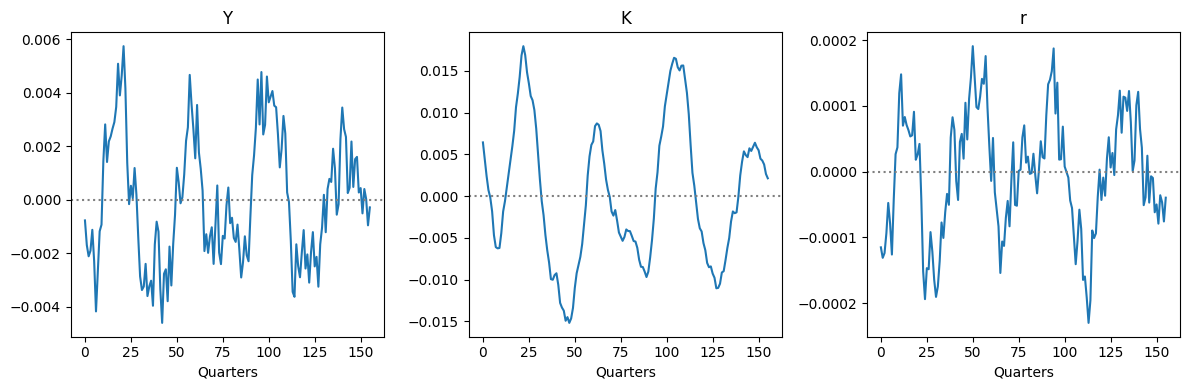

[23]:

from estimation.plots import plot_timeseries

from estimation.routines import simulate

[24]:

outputs = ["Y", "K", "r"]

sigmas = {"Z": 0.001}

rhos = {"Z": 0.8}

impulses = {}

for i in inputs:

own_shock = {i: sigmas[i] * rhos[i] ** np.arange(T)}

impulses[i] = ks.solve_impulse_linear(

SteadyState_Dict,

unknowns,

targets,

own_shock,

)

T_sim = 156 # 39 years, as in the original SW (2007) sample

data_simul = simulate(list(impulses.values()), outputs, T_sim)

plot_timeseries(data_simul, (1, 3), figsize=(12, 4))